lloyds contactless card limit Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases. Thanks for posting. We see you're unable to locate the NFC Tag Reader option in the Control Center on your iPhone. We're happy to share some information about this. .

0 · lloyds contactless payment limit uk

1 · lloyds contactless payment limit

2 · lloyds contactless not working

3 · lloyds contactless limit uk

4 · lloyds contactless card not working

5 · lloyds bank contactless payment limit

6 · contactless payment limit per day

7 · can you withdraw money contactless

WumiiboHelper is a homebrew application that helps you download and install wumiibo. (CIA) Install WumiiboHelper on the Home menu with FBI. Run WumiiboHelper and select Download Wumiibo to download and install .

According to new data from Lloyds Bank, spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April .Pay up to £100 by holding your card against a reader if your card is contactless. There’s no need to enter your PIN. Your contactless cards still have the same anti fraud protection as chip and PIN. Change your contactless limit to anything between £30 and £95. According to new data from Lloyds Bank, spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic – the contactless limit was increased . According to new data from Lloyds Bank* spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic - the contactless limit was increased from £30 to .

Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases.

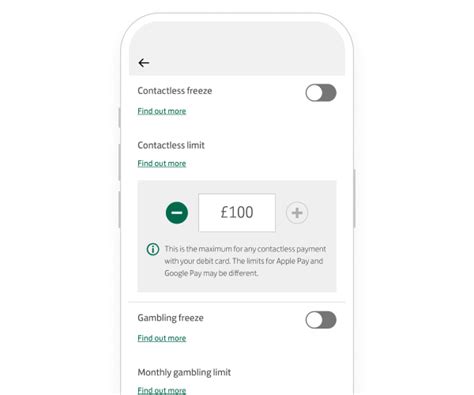

Since the feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit. Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their own contactless card limits from next month when the higher £100 cap comes into force. From 15 October, the contactless card limit will rise from £45 to £100. According to new data from Lloyds Bank, spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic – the contactless limit was increased . Furniture accounted for 77% of contactless payments, electrical 68% and average retail came in at 87%. Lloyds was the first bank to allow customers to choose their own contactless limit for spending – between £30 and £95 – on a debit or credit card.

The three Lloyds Banking Group institutions are adding new card control functions to their mobile apps that will enable customers to choose a spending limit of between £30 (US) and £95 (US0) and switch their card’s contactless functionality on and off. From October 15, the contactless limit for card payments will increase generally from £45 to £100. The increase will make card transactions swifter for customers, but there have been.Pay up to £100 by holding your card against a reader if your card is contactless. There’s no need to enter your PIN. Your contactless cards still have the same anti fraud protection as chip and PIN. Change your contactless limit to anything between £30 and £95. According to new data from Lloyds Bank, spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic – the contactless limit was increased .

smart sim card bts

According to new data from Lloyds Bank* spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic - the contactless limit was increased from £30 to .Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases. Since the feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit.

Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their own contactless card limits from next month when the higher £100 cap comes into force. From 15 October, the contactless card limit will rise from £45 to £100. According to new data from Lloyds Bank, spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic – the contactless limit was increased . Furniture accounted for 77% of contactless payments, electrical 68% and average retail came in at 87%. Lloyds was the first bank to allow customers to choose their own contactless limit for spending – between £30 and £95 – on a debit or credit card.

The three Lloyds Banking Group institutions are adding new card control functions to their mobile apps that will enable customers to choose a spending limit of between £30 (US) and £95 (US0) and switch their card’s contactless functionality on and off.

lloyds contactless payment limit uk

lloyds contactless payment limit

smart sc credit card

Custom On-Metal NFC Plastic Sticker. GoToTags can create custom, made-to-order NFC stickers with or without printing in a wide variety of shapes, sizes and materials.

lloyds contactless card limit|lloyds bank contactless payment limit