personal loan payments smart to pay off credit card debt With a personal loan, you can pay off your credit card debt right away and set up . If you choose “debit,” you’ll be asked for a personal identification number (PIN), and your Commuter Card doesn’t have a PIN. If you’d like to add an optional PIN to your Commuter .

0 · personal loan to pay off credit card debt

1 · personal loan for credit card payment

2 · personal loan credit card loan

3 · personal loan credit card debt

4 · pay off credit card debt online

5 · pay off credit card debt

6 · loans to pay off credit cards

7 · loans to pay credit card debt

An NFC card is a “Near Field Communication” card and communicates a small packet of data–like your employee status and access authorization–to an NFC reader. It’s very similar to an RFID card, except the .There so many factors. If the card is a high frequency card that your phone can read, and the student hostel only uses the serial number of the card (not the data stored on it), and you have a rooted Android phone and you have an app that can do that sort of thing (like NFC Card .

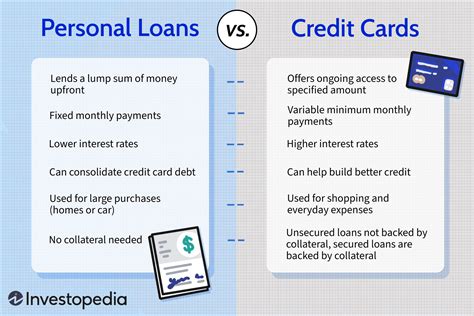

Some personal loans offer lower interest rates than credit cards. So consolidating your credit card debt with a personal loan may save you money on interest and potentially help you get out of debt faster. Read on to learn about the potential pros and cons of a personal loan for debt consolidation as well as . See moreUsing a personal loan to pay off credit cards may make sense in certain situations. Here are some of the potential benefits. See moreThe first step to getting a personal loan to pay off credit card debt is checking your credit scores and comparing lenders. Getting pre-qualified for a personal loan is a great way to . See moreThere’s no one-size-fits-all solution for chipping away at credit card debt. Apart from personal loans, here are some other potential ways to consolidate your card debt. See more

With a personal loan, you can pay off your credit card debt right away and set up .

The first step to getting a personal loan to pay off credit card debt is checking your credit scores and comparing lenders. Getting pre-qualified for a personal loan is a great way to estimate what your monthly payment might be. With a personal loan, you can pay off your credit card debt right away and set up a payment plan to repay your personal loan. Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying.

Pros and cons of taking out a personal loan to pay off credit card debt. Interest rates are typically lower than credit cards. One fixed monthly payment can make debt management easier..

Using a personal loan to pay off credit card debt can save money on interest and simplify monthly payments. Personal loans are still a form of debt, and it’s important not to.By taking the proceeds of a personal loan to pay off credit card debt, you can eliminate multiple monthly high-interest card payments and consolidate the debt into one monthly. Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards. One way is to apply for a personal loan to effectively move your debt from your credit card issuer to a personal loan lender and hopefully snag a smaller interest rate and better.

Quick Answer. If your credit card account has a steep APR and ballooning balance, it may be hard to repay with your existing income alone. You can get a personal loan to pay off your credit card, but first know the pros, cons and alternatives. Should I Use A Personal Loan To Pay Off My Credit Card Debt? Personal loans can be a great way to eliminate high-interest credit card debt. But it’s crucial to know the pros and cons of a loan for this purpose. Mar 25 2024 | 4 min read. The first step to getting a personal loan to pay off credit card debt is checking your credit scores and comparing lenders. Getting pre-qualified for a personal loan is a great way to estimate what your monthly payment might be. With a personal loan, you can pay off your credit card debt right away and set up a payment plan to repay your personal loan.

Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying.

personal loan to pay off credit card debt

personal loan for credit card payment

Pros and cons of taking out a personal loan to pay off credit card debt. Interest rates are typically lower than credit cards. One fixed monthly payment can make debt management easier..

Using a personal loan to pay off credit card debt can save money on interest and simplify monthly payments. Personal loans are still a form of debt, and it’s important not to.

By taking the proceeds of a personal loan to pay off credit card debt, you can eliminate multiple monthly high-interest card payments and consolidate the debt into one monthly.

Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards.

One way is to apply for a personal loan to effectively move your debt from your credit card issuer to a personal loan lender and hopefully snag a smaller interest rate and better. Quick Answer. If your credit card account has a steep APR and ballooning balance, it may be hard to repay with your existing income alone. You can get a personal loan to pay off your credit card, but first know the pros, cons and alternatives.

personal loan credit card loan

personal loan credit card debt

When you make a transaction, the digital wallet does not share with the merchant your actual credit card number but instead creates a one .

personal loan payments smart to pay off credit card debt|loans to pay off credit cards