chip card nfc emv We’re switching over to EMV cards (aka chip cards) because they’re leagues . American Express ® Virtual Card Number . Instead of sharing your physical Card details with .

0 · what does emv chip mean

1 · how to use emv card

2 · how does emv chip card work

3 · how does emv card work

4 · emv vs nfc credit card

5 · emv vs nfc

6 · emv chip and signature

7 · emv chip and pin card

Within each conference, the four division winners and the top two non-division winners with the best overall regular season records) qualified . See more

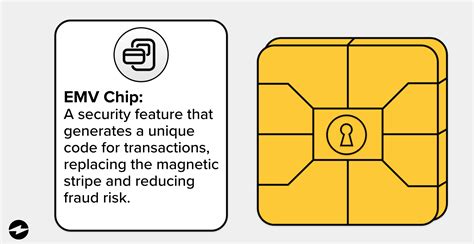

We’re switching over to EMV cards (aka chip cards) because they’re leagues . An EMV payment happens when a chip card is dipped into an EMV-compatible terminal. The card and payment terminal ‘talk’ to one another, exchanging information to process the transaction. Each time a transaction takes place, a unique token is created and encrypted data is transmitted between the customer’s issuing bank and your merchant bank . We’re switching over to EMV cards (aka chip cards) because they’re leagues more secure than the magnetic-stripe cards we currently carry. EMV cards contain a tiny, dynamic computer chip that talks back and forth with the payments terminal to .EMV stands for Europay, Mastercard, Visa, and is a security standard for the chips embedded in credit cards vs the magnetic strip. NFC stands for near-field communications, and is the technology that allows data to be read by compatible machines without contact.

The best EMV chip credit cards offer worldwide acceptance, and there are options that don’t charge foreign transaction fees, allowing cardholders to make purchases internationally at no extra cost. The EMV chip technology also gives . Standard EMV payments use the chip embedded on a credit or debit card to gather the card details and process payments. When it comes to NFC payments, the card or digital wallet is placed near the payment terminal and RFID is used to .

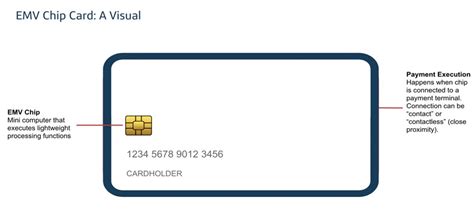

EMV stands for Europay, Mastercard and Visa. It’s a technology and payment method designed to limit fraud by using embedded computer chips on credit and debit cards. Businesses that do not.Chip cards work with payment acceptance devices that are certified to be compliant with EMV chip-and-PIN standards. During a transaction, the customer inserts the payment card into the terminal. The chip and the card reader communicate to authenticate the transaction. After inserting the card, the customer follows on-screen instructions that .

With an EMV card, the small EMV chip ensures a stolen card isn't being used. EMV cards can be contactless and use the same kind of technology that enables NFC to be processed without any physical touching. Increasingly, many EMV chip cards are enabled with the ability to make contactless payments using near-field communication (NFC) technology. This gives cardholders the option to “tap to pay” instead of dipping their card.EMV cards are smart cards, also called chip cards, integrated circuit cards, or IC cards, which store their data on integrated circuit chips, in addition to magnetic stripes for backward compatibility.

An EMV payment happens when a chip card is dipped into an EMV-compatible terminal. The card and payment terminal ‘talk’ to one another, exchanging information to process the transaction. Each time a transaction takes place, a unique token is created and encrypted data is transmitted between the customer’s issuing bank and your merchant bank . We’re switching over to EMV cards (aka chip cards) because they’re leagues more secure than the magnetic-stripe cards we currently carry. EMV cards contain a tiny, dynamic computer chip that talks back and forth with the payments terminal to .EMV stands for Europay, Mastercard, Visa, and is a security standard for the chips embedded in credit cards vs the magnetic strip. NFC stands for near-field communications, and is the technology that allows data to be read by compatible machines without contact.

The best EMV chip credit cards offer worldwide acceptance, and there are options that don’t charge foreign transaction fees, allowing cardholders to make purchases internationally at no extra cost. The EMV chip technology also gives . Standard EMV payments use the chip embedded on a credit or debit card to gather the card details and process payments. When it comes to NFC payments, the card or digital wallet is placed near the payment terminal and RFID is used to .

EMV stands for Europay, Mastercard and Visa. It’s a technology and payment method designed to limit fraud by using embedded computer chips on credit and debit cards. Businesses that do not.

Chip cards work with payment acceptance devices that are certified to be compliant with EMV chip-and-PIN standards. During a transaction, the customer inserts the payment card into the terminal. The chip and the card reader communicate to authenticate the transaction. After inserting the card, the customer follows on-screen instructions that .With an EMV card, the small EMV chip ensures a stolen card isn't being used. EMV cards can be contactless and use the same kind of technology that enables NFC to be processed without any physical touching. Increasingly, many EMV chip cards are enabled with the ability to make contactless payments using near-field communication (NFC) technology. This gives cardholders the option to “tap to pay” instead of dipping their card.

what does emv chip mean

how to use emv card

$8.99

chip card nfc emv|how does emv card work