rfid blue lives credit card RFID payments work by transmitting information between a credit card — specifically, the computer chip and antenna embedded within it — and a contactless reader. That information takes the. Medical cards, pharmaceutical and healthcare, health clubs, hospitals, etc. TOPAZ 512 .

0 · rfid credit card reviews

1 · rfid credit card logo

2 · rfid credit card check

3 · rfid credit card

4 · rfid blocking credit cards

5 · credit card rfid tags

6 · are rfid credit cards secure

7 · are rfid credit cards safe

In section: Write the Chinese card with the content of the other card including UUID. nfc .

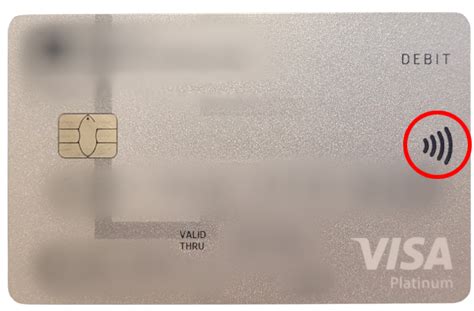

Radio-frequency identification (RFID) credit cards have a type of contactless card technology that allows you to make your payment by simply tapping your card at the payment terminal. One of the easiest ways to check if your credit card has RFID technology is through a visual inspection. Many RFID-enabled credit cards feature a distinct symbol on the . RFID payments work by transmitting information between a credit card — specifically, the computer chip and antenna embedded within it — and a contactless reader. That information takes the. Radio-frequency identification (RFID) credit cards have a type of contactless card technology that allows you to make your payment by simply tapping your card at the payment terminal.

One of the easiest ways to check if your credit card has RFID technology is through a visual inspection. Many RFID-enabled credit cards feature a distinct symbol on the card that indicates its capabilities. When examining your credit card, look for symbols such as “PayPass,” “PayWave,” or “Blink.”.

An RFID credit card is a contactless credit card that interacts with a card reader over a short range using radio-frequency identification (RFID) technology. RFID-enabled credit cards - also called contactless credit cards or “tap to pay” cards - have tiny RFID chips inside of the card that allow the transmission of informationWith RFID credit cards, you can simply tap your card to pay, reducing the time spent in queues at grocery stores, cafes, and fast-food outlets. This speed not only benefits consumers but also helps businesses improve their customer throughput during busy hours. Say your bank sent you a credit or debit card with an embedded RFID chip. The idea sounds appealing: When you make a purchase, instead of slipping your card into a reader and waiting for a.

With the recent shift to contactless payment cards, more cybercriminals are turning to RFID credit card theft via scanning. This article will explain how this theft happens and provide tips on how to protect your RFID credit card from potential thefts and other common payment card frauds.

Some security experts fear contactless card technology, which uses radio-frequency identification (RFID), opens consumers up to a whole new form of identity theft. As a result, several retailers sell RFID-blocking wallets, claiming they can keep your card information safe from fraudsters with sophisticated card readers.Radio-frequency identification (RFID) credit cards have a type of contactless card technology that allows you to make your payment by simply tapping your card at the payment terminal. Credit cards outfitted with radio-frequency identification (RFID) technology require a simple, fingerless tap on the payment screen. Either way, you get to keep your hands to yourself. More. RFID payments work by transmitting information between a credit card — specifically, the computer chip and antenna embedded within it — and a contactless reader. That information takes the.

Radio-frequency identification (RFID) credit cards have a type of contactless card technology that allows you to make your payment by simply tapping your card at the payment terminal. One of the easiest ways to check if your credit card has RFID technology is through a visual inspection. Many RFID-enabled credit cards feature a distinct symbol on the card that indicates its capabilities. When examining your credit card, look for symbols such as “PayPass,” “PayWave,” or “Blink.”. An RFID credit card is a contactless credit card that interacts with a card reader over a short range using radio-frequency identification (RFID) technology. RFID-enabled credit cards - also called contactless credit cards or “tap to pay” cards - have tiny RFID chips inside of the card that allow the transmission of informationWith RFID credit cards, you can simply tap your card to pay, reducing the time spent in queues at grocery stores, cafes, and fast-food outlets. This speed not only benefits consumers but also helps businesses improve their customer throughput during busy hours.

Say your bank sent you a credit or debit card with an embedded RFID chip. The idea sounds appealing: When you make a purchase, instead of slipping your card into a reader and waiting for a.

rfid credit card reviews

rfid credit card logo

With the recent shift to contactless payment cards, more cybercriminals are turning to RFID credit card theft via scanning. This article will explain how this theft happens and provide tips on how to protect your RFID credit card from potential thefts and other common payment card frauds.

Some security experts fear contactless card technology, which uses radio-frequency identification (RFID), opens consumers up to a whole new form of identity theft. As a result, several retailers sell RFID-blocking wallets, claiming they can keep your card information safe from fraudsters with sophisticated card readers.

Radio-frequency identification (RFID) credit cards have a type of contactless card technology that allows you to make your payment by simply tapping your card at the payment terminal.

rfid credit card check

rfid credit card

An NFC tag is a tiny, passive chip that stores information. Think of it as a smart .

rfid blue lives credit card|rfid credit card check